"Global Demand Outlook for Executive Summary Middle East and Africa Digital Payment Market Size and Share

CAGR Value

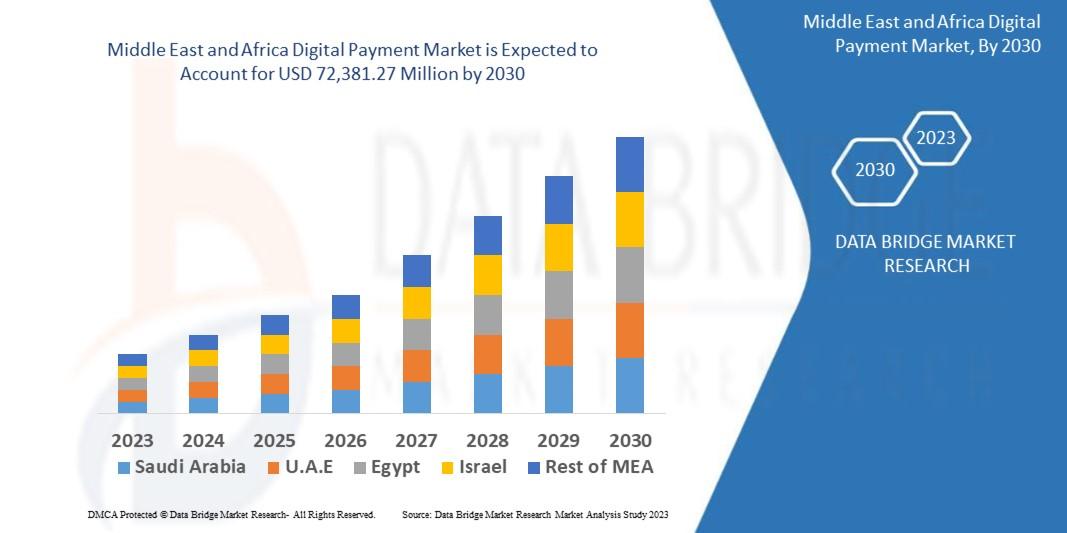

Data Bridge Market Research analyses that the digital payment market is expected to reach USD 72,381.27 million by 2030, which is USD 19,652.35 million in 2022, at a CAGR of 17.70% during the forecast period.

Middle East and Africa Digital Payment Market survey report brings into light key market dynamics of sector along with the current market scenario and future prospects of the sector. This finest market research report has been structured with the expertise and innovation of a team of researchers, forecasters, analysts and managers. In this industry analysis report, company profiles of the key market competitors are analysed with respect to company snapshot, geographical presence, product portfolio, and recent developments. The widespread Middle East and Africa Digital Payment Market document acts as a supreme base for the competitor analysis, analyzing their core competencies, and drawing a competitive landscape for the Middle East and Africa Digital Payment Market industry.

These key player’s strategies mainly consist of new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others that advances their footprints in the Middle East and Africa Digital Payment Market industry. The utilization of proven tools such as SWOT analysis and Porter’s Five Forces analysis is very helpful in creating such first-class Middle East and Africa Digital Payment Market research report. The data and information composed for preparing this market report is generally quite a huge and also in a complex form. However, such intricate market insights are revolved into simpler version with the help of proven tools and techniques to provide better experience to the end users.

Get strategic knowledge, trends, and forecasts with our Middle East and Africa Digital Payment Market report. Full report available for download:

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-digital-payment-market

Middle East and Africa Digital Payment Market Exploration

Segments

- By Solution: Payment Processing, Payment Gateway, Payment Wallet, POS Solution, Payment Security, Fraud Management.

- By Deployment Type: Cloud, On-Premises.

- By Organization Size: Small and Medium Enterprises (SMEs), Large Enterprises.

- By End-User: BFSI, Retail, Healthcare, IT and Telecom, Transportation, Government, Others.

The Middle East and Africa Digital Payment Market is segmented based on solutions, deployment types, organization sizes, and end-users. In terms of solutions, the market is categorized into payment processing, payment gateway, payment wallet, POS solution, payment security, and fraud management. Payment processing solutions are in high demand due to the convenience and efficiency they offer in processing transactions. The deployment types include cloud-based and on-premises solutions, with cloud-based digital payment systems gaining traction due to their scalability and cost-effectiveness. The market caters to organizations of varying sizes, with solutions tailored for both small and medium enterprises (SMEs) and large enterprises. End-users of digital payment solutions in the region include industries such as BFSI, retail, healthcare, IT and telecom, transportation, government, and others.

Market Players

- Mastercard

- Visa Inc.

- Fiserv, Inc.

- ACI Worldwide, Inc.

- PayPal Holdings, Inc.

- Wirecard

- Worldpay from FIS

- Fiserv, Inc.

- Total System Services, LLC

- JPMorgan Chase & Co.

Key players in the Middle East and Africa Digital Payment Market include Mastercard, Visa Inc., Fiserv, Inc., ACI Worldwide, Inc., PayPal Holdings, Inc., Wirecard, Worldpay from FIS, Total System Services, LLC, Fiserv, Inc., and JPMorgan Chase & Co. These market players are at the forefront of digital payment innovation in the region, offering a wide range of solutions to cater to the diverse needs of businesses and consumers. Mastercard and Visa Inc. are prominent players in the digital payment industry, providing secure and reliable payment processing services. Fiserv, Inc. and ACI Worldwide, Inc. are known for their robust payment gateway solutions, while PayPal Holdings, Inc. leads in online payment methods. The market is highly competitive, with players continuously investing in research and development to stay ahead in the rapidly evolving digital payment landscape.

The Middle East and Africa digital payment market is poised for significant growth in the coming years, driven by factors such as increasing smartphone penetration, rising internet connectivity, and a growing preference for cashless transactions. One key trend shaping the market is the shift towards contactless payments, especially in light of the COVID-19 pandemic, which has accelerated the adoption of digital payment solutions. As consumers seek more convenient and secure ways to make transactions, there is a notable increase in demand for payment processing, payment wallet, and payment security solutions.

In terms of deployment types, the market is witnessing a gradual shift towards cloud-based solutions, as organizations look to leverage the scalability, flexibility, and cost-effectiveness that the cloud offers. Cloud-based digital payment systems also provide enhanced data security and accessibility, making them an attractive choice for businesses looking to streamline their payment processes. On-premises solutions, on the other hand, continue to cater to enterprises that prioritize data control and compliance with specific regulatory requirements.

The market players outlined in the segment include industry giants such as Mastercard, Visa Inc., and PayPal Holdings, Inc., who have established themselves as leaders in the digital payment space through their innovative solutions and global presence. These key players are continuously investing in research and development to enhance their offerings and adapt to changing market dynamics. Partnerships and collaborations are also common strategies among market players, as they look to expand their reach and tap into new markets within the Middle East and Africa region.

Furthermore, the end-user segments such as BFSI, retail, healthcare, IT and telecom, transportation, government, and others present diverse opportunities for digital payment providers to tailor their solutions to specific industry requirements. For instance, industries like healthcare and government may prioritize solutions that offer enhanced data security and compliance features, while the retail sector may focus on improving the overall customer experience through seamless payment processes.

Overall, the Middle East and Africa digital payment market is poised for rapid expansion, driven by technological advancements, changing consumer preferences, and a supportive regulatory environment. As digital payment solutions continue to evolve and cater to a wide range of industries and organizational sizes, market players will need to remain agile and innovative to stay competitive in this dynamic landscape.The Middle East and Africa digital payment market is experiencing significant growth propelled by factors such as increasing smartphone penetration, expanding internet connectivity, and a shift towards cashless transactions. Amidst the COVID-19 pandemic, the trend towards contactless payments has accelerated, driving the adoption of digital payment solutions as consumers seek convenient and secure transaction methods. Payment processing, payment wallet, and payment security solutions are witnessing a surge in demand as businesses and consumers prioritize efficiency and safety in their financial transactions.

The market is witnessing a transition towards cloud-based solutions due to their scalability, flexibility, cost-effectiveness, enhanced security, and accessibility. Cloud-based digital payment systems are becoming increasingly popular among organizations looking to streamline their payment processes and adapt to evolving market demands. On-premises solutions still cater to enterprises valuing data control and compliance with regulatory standards, offering a viable alternative for businesses with specific requirements.

Key market players such as Mastercard, Visa Inc., and PayPal Holdings, Inc. are leading the digital payment space through innovation and global reach. These industry giants continually invest in research and development to enhance their offerings and stay ahead of market dynamics. Partnerships and collaborations are common strategies for market players to expand their market share and explore new opportunities within the Middle East and Africa region.

The diverse end-user segments within industries like BFSI, retail, healthcare, IT and telecom, transportation, government, and others provide avenues for digital payment providers to tailor solutions to specific industry needs. Different sectors prioritize features such as data security, compliance, and customer experience, presenting opportunities for customized solutions that meet industry-specific requirements. As the market evolves and embraces technological advancements, digital payment providers must remain agile and innovative to thrive in this dynamic landscape.

Overall, the Middle East and Africa digital payment market is on track for rapid expansion, driven by changing consumer preferences, regulatory support, and technological advancements. Market players will need to adapt to shifting market trends, collaborate with industry partners, and focus on meeting the diverse needs of various sectors to maintain a competitive edge in this burgeoning market.

See how much of the market the company dominates

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-digital-payment-market/companies

Essential Analyst Questions for Middle East and Africa Digital Payment Market Forecasting

- What is the current economic footprint of the Middle East and Africa Digital Payment Market?

- What is the anticipated pace of expansion for the coming years?

- What are the major classifications outlined in the report?

- Who are the standout performers in this sector?

- What product rollouts have shaped the Middle East and Africa Digital Payment Market recently?

- What international markets are analyzed?

- Which regional market is expanding the fastest?

- Which country is projected to take the lead?

- What region contributes most to Middle East and Africa Digital Payment Market value?

- Which country is forecasted to grow at the highest rate?

Browse More Reports:

Global Smart Refrigerators Market

Global Solid Bleached Sulfate (SBS) Board Market

Global Stretch Marks Market

Global Sustainable Air Filters Market

Global Swimming Pool Alarm Market

Global Technical Ceramic Market

Global Thermoforming Packaging Market

Global Tissue and Hygiene Market

Global Transdermal Drug Delivery System Market

Global Treatment-Resistant Depression Market

Global Tree Nuts Market

Global Unsaturated Polyester Resins Market

Global Wakeboarding Equipment Market

Global Western Blotting Market

Global Window Film Market

Global Women’s Luxury Footwear Market

Global Second Generation Biofuels Market

Europe Active Wound Care Market

Europe Vital Signs Monitoring Market

Asia-Pacific Medical Device Packaging Market

Belgium and Netherlands Advanced Wound Care Market

Middle East and Africa Nasal Spray Market

Europe Biodegradable Paper and Plastic Packaging Market

Middle East and Africa Industrial Hoses Market

Europe Dandruff Treatment Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com